FALSE STATEMENT: The Township is already providing the law enforcement in The Woodlands.

Currently, the bulk of the law enforcement expenses are borne by the counties since The Woodlands is an unincorporated part of the counties. Harris and Montgomery County provide supervisors above the rank of Sergeant; Specialty Investigators (Narcotics, Human Trafficking, Auto Theft, Major Cases and Internal Affairs); SWAT Teams; Canine Teams; Victims Services; Crime Lab; Crime Scene; Property/Evidence; Dispatch; Policy and Planning/Accreditation; Quartermaster; Crime Data Analysis; Records Management; Recruitment and Training; and Media/Communications. The counties also provide and maintain vehicles and equipment (except for some recent MC vehicles), house all personnel and functions in appropriate facilities and provide the administrative backup required for Technology, Human Resources, Finance and Legal/Liability assistance. The counties fully fund the Jail, Magistrate Court and Animal Control. In addition, Montgomery County provides 22.5 FTEs (20 sworn officers and 2.5 civilians). So, the bulk of LE comes from our county property taxes. Over the years, The Township negotiated contracts to pay HC and MC for additional personnel to enhance county-provided law enforcement and to ensure that officers were dedicated to Creekside (HC) or the other villages (MC). The 2021 Forecast for these contracts is $11.5M.

Background: First, the Township does not currently provide law enforcement. The counties pay for law enforcement with our county property taxes (see functions above) and the Township supplements with additional patrol officers so that the counties will dedicate officers specifically to The Woodlands to employ the community policing model. The community policing model requires more patrol and we contract and pay for that additional coverage. While patrol may be the most visible aspect of law enforcement, there is much, much more to law enforcement than patrol and the counties provide all aspects of law enforcement except what is specifically contracted for. See Sheriff Rand Henderson’s remarks at The Woodlands Area Chamber of Commerce Incorporation Education Session on 8/23/21 on WoodlandsOnline.

Second, upon incorporation, those functions listed above become the responsibility of the new city. Regarding how the new city will provide law enforcement, there is a bit of the “bait and switch” going on. It’s important to distinguish between what is being referred to as “The Plan” which results in the misleading “no new tax” claim and relies on the understated cost of the “Hybrid Model” – and the promise of a unitary Police Department which is not in “The Plan” and is much more expensive.

Third, the “Hybrid Model” provides no advantages over the current Township contract but costs more and continues to treat Creekside Park differently. The “Hybrid Model” was a created at the suggestion of the Board when it became apparent after the first report by the consultants that continuing the contract model was not possible (because the contract only covered part of law enforcement) and the Police Department would be too expensive. The “Hybrid Model” went through several versions. In the latest, Creekside Park would continue to be served by the Harris County Constables, although it is not clear how the county would be compensated for providing the functions beyond patrol. A small police department would be formed in the Montgomery County area of the city to enforce ordinances and as the city transitioned away from its contract officers with Montgomery County, the city would hire officers to replace them over 4 years. Upon incorporation, we would lose the right to the 22.5 officers (or 22.5 plus 4 jailers as reflected in an earlier Novak report) provided without direct charge as basic law enforcement as well as all of the above functions currently provided by the county – all of which we now receive as an unincorporated part of the county for our county property taxes. Property owners will pay the same tax to the county whether we are a city or remain The Township. “The Plan” does not appear to recognize all these costs, thus understating even the Hybrid Model.

Fourth, a unitary Police Department has been discussed extensively, but its full cost is not in ‘The Plan” and it surely will be much more expensive than “The Plan”. While the policing we currently receive from the counties has produced outstanding public safety for the residents of The Woodlands and does not need to be replaced, IF the residents agree to incorporate, they will surely want a Police Department that serves the entire city. What do we know about what would be required to fully stand up a City-wide Police Department? Some of the issues have not been discussed. We would need to work through the issues involved in providing policing in two different counties. For example, dispatch in two counties creates some gnarly issues. So does different court systems and procedures. Some of the issues have been discussed, but not resolved in the SEVEN reports that have been issued by consultants. The last Law Enforcement report was issued January 15, 2020 and was not a Final Report.

Police Department Facility. The Board said it wanted to include the cost of the Police Department Facility starting in Year 4. The Township has already spent $15M on land that could be used for City Hall and a Police Department. Conroe opened its new 76,000 square foot Police Department and Municipal Court in 2016 with a $28M price tag. A Woodlands PD ten years later and estimated to be 85,600 square feet, will likely be closer to $35M, although the consultants estimated $30M. Then the games began. In their February 26, 2020 Presentation and again in their May 2020 Report, the consultants presented debt service of $1.82M starting in year 5. This assumes borrowing $30M over a 20 year term. However, at the Special Board Meeting to place incorporation on the ballot, Township Staff presented a different scenario entirely. They “updated” the debt service to reflect a 30 year term at a significantly lower interest rate and reduced the principal to $14M, claiming that the other $16M would be paid out of Incorporation Reserves, effectively reducing the debt service from $1.8M to $500,000. But then, they zeroed out the debt service, claiming that any cost requiring voter approval could not be included in the cost estimates. And just like that – the Police Department disappeared from the property tax rate. (See slide 46).

Varying Staffing Estimates. The largest expense of a Police Department is its Personnel. Therefore, accurate estimates of personnel needs are essential to accurately estimating the necessary expenses of a Police Department. Exclusive of Municipal Court personnel, the 2011 Novak report estimated that 181.5 FTE personnel would be required to fully staff a Police Department. The fall of 2018 Matrix reports reflect 155.5 FTE Police Department personnel. The October 2019 Novak report shows a Police Department staffed at 204.5 FTEs. The most recent Novak report from January 15, 2020 reflects 208.5 FTE would be required for a fully staffed Police Department. According to the same report, the Township pays for 89 MC Sheriff’s Office personnel, 12 HC Constables Office personnel, and 3 MC Constables Office personnel for a total of 104 contract positions. Thus, according to the most recent Novak report, we would need to fund an additional 104.5 positions – essentially double the paid staff in order to stand up a Police Department. As earlier discussed, this does not include vehicles, equipment, supplies, training, facilities, etc. but is merely the personnel component of a Police Department expenses. It also does not include a risk factor for liability for actions of the police officers. Officers and the city are routinely sued and cases are settled for varying amounts. Of course ,the most recent example was the Minneapolis City settlement with George Floyd’s family for $27M. There is no budget for staff-related liabilities.

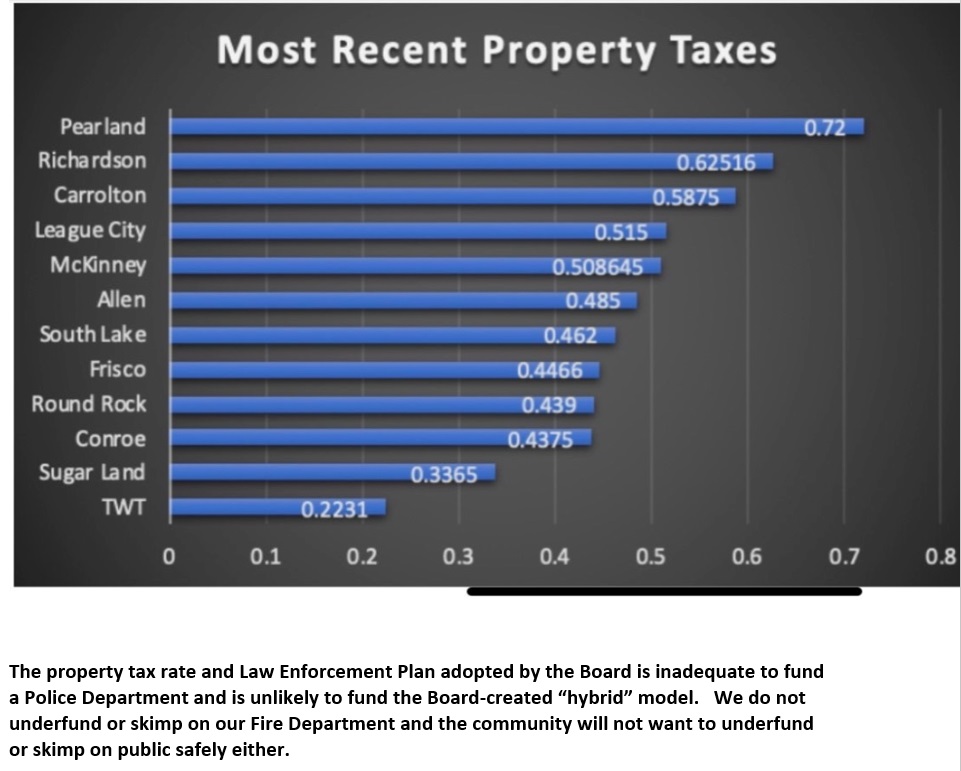

Another way to estimate personnel needs is to compare with the peer cities. The peer cities selected by the Board were Allen (198 FTEs), Frisco (325 FTEs), Round Rock (254 FTEs) and Sugar Land (229 FTEs). South Lake should not be considered a peer city because of its much smaller population. The average of those 4 cities is 251.5 FTEs, considerably higher than Novak’s estimate of 208.5. It should be noted as well, that, of the 9 cities suggested as peers by the consultants, the Board chose these 4 cities that have the 4 lowest property tax rates. Thus, there is a real danger that both the Police Department requirements and thus the proposed property tax rate are too low. The chart below shows property taxes as of June 2021 for the 9 peer cities proposed by consultants as well as South Lake which was added by one of the Directors and Conroe as the largest city in Montgomery County.